Scalar units of account like USD provide a single standardized (scalar) measure of value for all transactions in all dimensions of value across a market. In contrast, a vector derived from a relative price index represents multiple values simultaneously, maintaining relative worth between diverse assets without relying a single standard measure.

Expanding from a single scalar unit of account, like the USD, into a relative price index vector is akin to Dirac's use of a four-dimensional vector in the wave equation, which revealed previously unknown states of matter. Just as Dirac's approach expanded our understanding of the physical universe, moving to a vector-based system for our units of account allows us to perceive and interact with the economic space in a more nuanced and multidimensional manner. This shift enables the discovery of new economic relationships and potentials, similar to uncovering new states of matter.

In essence, moving to vector math in economics allows for a richer, more nuanced understanding of value, reflecting the complexity of human needs and societal priorities more accurately than a single scalar measure like the USD could ever achieve. For example, instead of measuring all goods in terms of USD, a vector approach might measure bread, fish, and fuel in their respective units while maintaining their inherent value relationships.

Imagine a relative value (aka price) index like A 1, B 1, C 2 Where C (1 liter of fuel) is worth twice as much A (1 loaf of bread) or an A (loaf) and a B (a 1 kg fish) as a vector in the A,B,C space/ economic dimensions. The vector in A,B,C [1,1,2] points in a certain direction in that space. If the relative values A = 1 and B = 1 and C = 2 were based on market rates in dollars , like A = $1 USD (of bread) and B= $1 USD (of fish) and C = $2 USD (of fuel) and the price index [1,1,2] is used to enables exchange between A, B and C, the rate of A to B is rate_A / rate_B = 1/1 = 1 and the rate of B to C is is rate_B / rate_C = 1/2 = 0.5 These relative values would be the same if the USD value or price shot up to 10x where it was. If A = $10 USD (of bread) and B= $10 USD (of fish) and C = $20 USD (of fuel) and the price index (vector) is now [10,10,20] the relative prices are still the same; the rate of A to B is rate_A / rate_B = 10/10 = 1 and the rate of B to C is is rate_B / rate_C = 10/20 = 0.5

So the relative value index has an interesting property, instead of a scalar unit of account we have a derived vector that can be imagined to point in a specific direction (or value) in the A,B,C economic dimension. (A) could be a formalized legal commitment (contract) against loaves of bread, B could be a commitment toward the goods and services of a group of fishermen, and C could be a commitment toward fuel. In the exchange space or pool - each commitment (a unit vector in their own space) is given a relative value to the others, creating a vector or direction in that space (pool) – all this is among a market or network of other pools. This form of unit of account derived from a relative value index is similar to what Keynes was talking about with Bancor (as a proposed global unit of account). But instead of starting with a global top-town version, each person, community, region could have their own relative value index and those can interact and aggregate into larger regional indices (and vector units of account). This ties up back to the Commitment Pooling protocol based on indigenous practices and ancient wisdom where commitments (promises of goods, services, or value) are aggregated, allowing participants to exchange these commitments based on established values relative to one another.

So what happens with the relative value of A,B and C when or if the value of the USD were to collapse?

If after a collapse A = $10,000 USD (bread) and B = $10,000 USD (fish) and C = $20,000 USD (of fuel) and they maintain their relative value index as [10000, 10000, 20000] their relative values to each other stay the same. One could still exchange fish for bread at the same 1:1 rate they did before. Of course these ratios would likely change for certain commitments of resources, and the pool operators could reflect those in a new index - or decouple from the USD market in the extreme case where the USD is no longer viable.

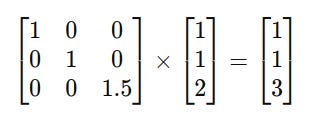

This accounting vector can be operated on by generators to see how it interacts with a market or other conditions while preserving certain elements. Consider the relative value index vector [1,1,2] within our commitment pool. Let's apply a matrix representing market conditions across a region, adjusting the prices due to specific regional factors:

This result shows how, even with an increase in the value of transportation services (reflected by the factor 1.5 in the matrix), the pool can adapt, recalibrating the internal exchange rates without impacting the fundamental 1:1 exchange rate between bread and fish.

Economic Collapse vs Economic Scaffold

If you were worried about the collapse of the USD or any National Currency or simply wanted to strengthen it - What would you want people to do? If there were some trillions of dollars of assets added to the market - all denominated in USD that would certainly help. Consider how OPEC - with oil denominated in USD boosts the USD itself. OPEC’s control over oil pricing and production levels has significant impacts on global oil markets and, by extension, on the demand for the USD as the primary currency for oil transactions. If everyone can (or must) buy oil in USD it creates a demand for USD. So if communities, businesses and groups across the US were to create formalized commitments denominated in USD and have them curated and placed in pools (that enable exchange) with relative value indices - there would be a diverse their portfolio of curated assets people can exchange (providing liquidity). This form of liquidity investment would be a way to do 2 things:

#1 Scaffolding (supporting from the bottom up) a failing USD (or other National Currencies used as units of account ). Consider a scenario where the local currency is fluctuating: by creating a commitment pool with assets denominated in both national currency, communities can retain purchasing power and ensure continued access to essential goods, thus scaffolding the national economy.

#2 Cultivating an economic commons and exchange system that is immune to USD (or other National Currency) scarcity or collapse.

Join the movement towards a more inclusive and resilient economic system by exploring and contributing to community-based commitment pools. Engage in discussions, attend workshops, and collaborate with your community to build an economic system that reflects collective values and needs.

Hi Will

Interesting idea but how to really anchor it in economic reality, where regular money does exactly the opposite (very efficiently) and erasing all different aspects of wealth, melting it into one single number? It would need strong "dimensions" like different communities with certain values they live and fix for themselves (and would not easily bend). Maybe then, in trading between them and others they could implement a multidemensional clearing to pass their values also to the outside and filter foreign goods to fit in their own value system.

Years ago we had a pilot with a local (paper) money that had, like a check but as a list, the date, reason/content and the buyers name of the last transactions on it, so registering where the specific bill was passing. There you had like three dimensions as in the next purchase, the seller could reject certain bills as he/she would not like the reason or the people who were using this bill before. This was a measure/try to make transactions transparent and hinder unethical trade in an analog way. It was an interesting story but stopped after two years.

I am working on a project which is explicitly about foreign exchange (as in Keynes' Bancor that Will cites) among the local/regional alternative currencies that Will has lost faith in. So definitely a different model but overlapping math. Its working title is "oSwaps" and you can see more here. https://docs.google.com/document/d/1bTmC7q4ZZ5mRnV9lbdmUJJcFee6a2D0i0FU7ORvYndY/edit?usp=drivesdk

In this model relative values are floating rather than curated, although I anticipate "curators" (local/regional governance mechanisms) would take actions within their economic scope to encourage stability in relative valuation (exchange rates).